It doesn’t seem that long ago that we were celebrating the start of 2017. I hate to break it to you, but the new tax year will start in a few weeks. Now is a very good time to start thinking about Junior ISAs for your kids (JISAs for short).

I’ve long held the belief that JISAs are an important part of the mix when saving for your kids’ future. In addition to the tax benefits (although these depend on your individual circumstances and may change over time), the money is ring-fenced and can’t be withdrawn until your child reaches the age of 18.

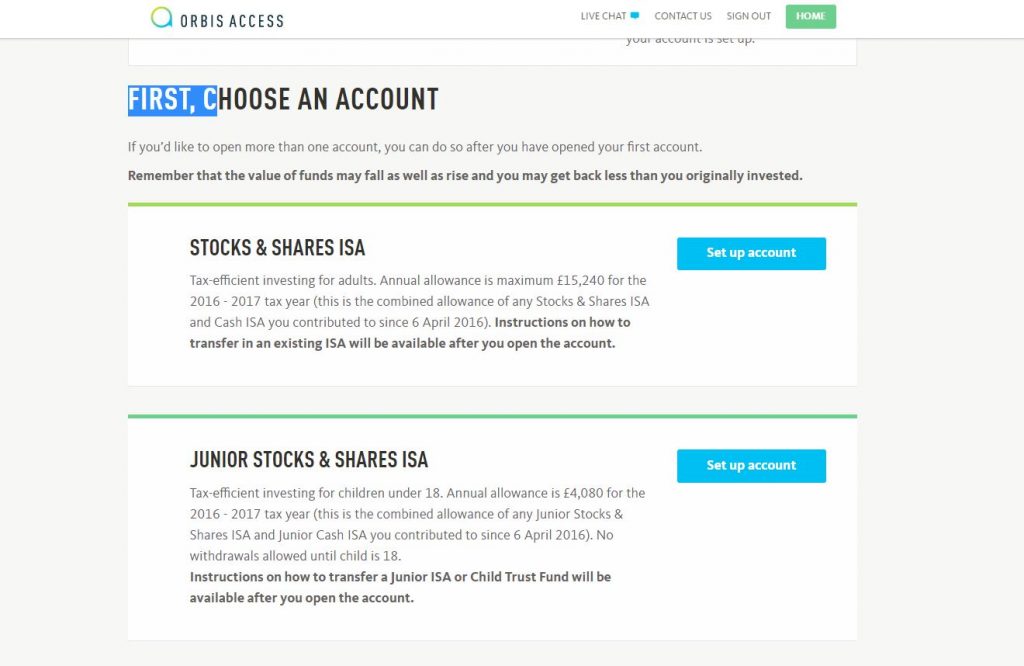

As it happens, I have just opened a JISA for a family member. Having looked at various investment companies, I plumped for one with Orbis Access.

It turns out to be the ideal time to invest with Orbis Access as the company is waiving its management fees on any money invested in the first 12 months of opening an account, giving your child up to 18 years of savings in fees. You can find out more about its Junior ISA Fee-Free offer here.

To get you started, if you open a JISA with Orbis before 30 April 2017, the company also match your first investment – up to £100. Orbis will do this for each new account so you can benefit from the offer more than once!

Here are my first impressions on dealing with the company and its website.

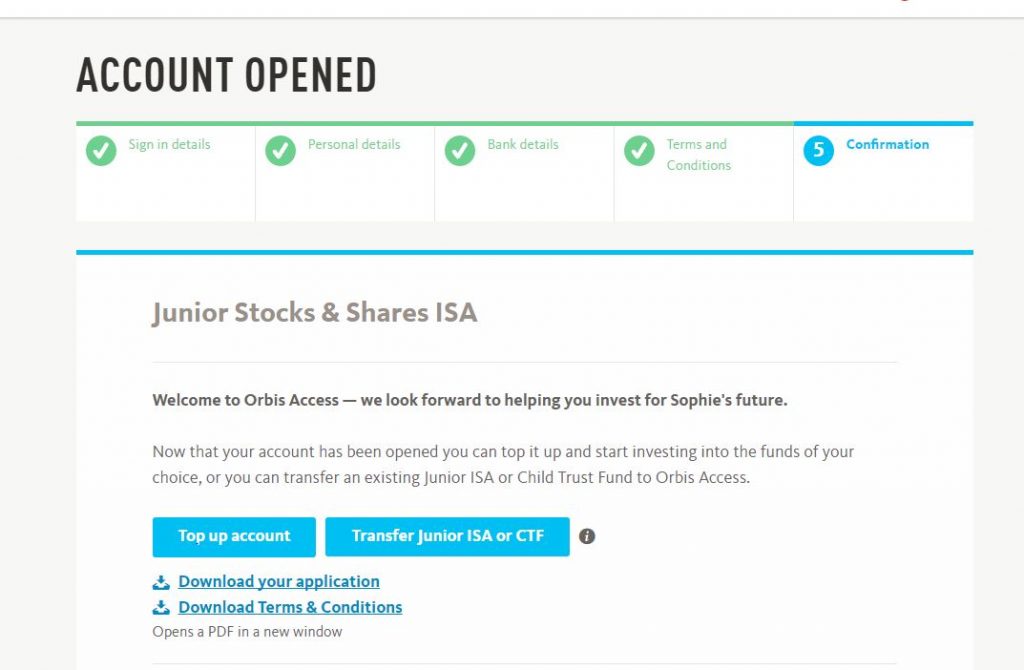

It was incredibly straightforward to set the JISA up, much more so than I was expecting. I had the account up and running within 10 minutes.

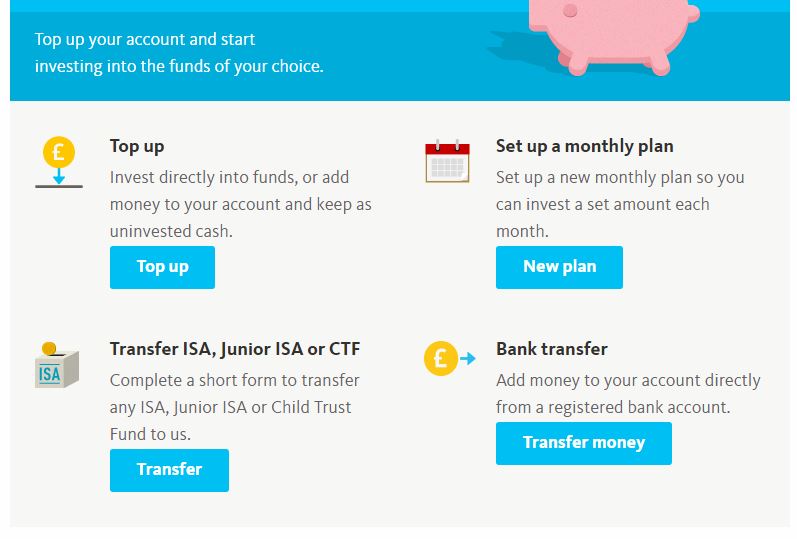

Once the account was operational, I was presented with an option to invest money into the JISA, transfer in an existing JISA or Child Trust Fund or to set up a monthly payment in one of Orbis’s two funds. I should mention that if the funds go down in value you could end up with less than you put in. In other words, the capital you invest in an Orbis JISA is at risk. There is more information about the funds and how they are invested on the website so I won’t go into the detail here but you must make an investment into either one, or both of the funds in order to receive the matched investment so do keep that in mind.

I also had a good play with the website and couldn’t resist trying out the ‘Live Chat’ function. I find Live Chat functions can be very disappointing with questions going unanswered but I got an instant answer to my query about transferring funds into a JISA.

One of the great things about JISAs is that once set up, anyone can contribute to them. Grandparents, aunts and uncles, Godparents, all can make contributions to your child’s future. Over the past couple of years, we’ve increasingly asked family to gift to our children in this way as we can see they will need every penny they can get as they set out into the world on their own.

Getting the account up and running was very simple and it’s great to know the initial investments I make into the JISA within the first 12 months won’t incur any fees from Orbis Access up until my child’s 18th birthday. What’s more, with Orbis’s current offer to match your first investment up to £100, this is a great way to take advantage of your JISA allowance. You have until April 30 to take up the offer.

Remember, the end of the tax year is less than a month away. If you need to invest for your children’s future or are curious about doing so, best to take action now.

Disclosure: this post was produced in collaboration with Orbis Access and has been approved for issue in the United Kingdom by Orbis Access (UK) Limited which is authorised and regulated by the Financial Conduct Authority.

8 thoughts on “JISA: Never a better time to invest”

I’ve been meaning to start saving for my kids. They all have standard bank accounts, but know that these won’t get them far. Junior ISAs look like a great option.

Junior ISAs are awesome. The thing I like is that once the money is in there, it can’t be moved. It’s invested for the kids and the kids only.

The new financial year always passes me by and I forget to put extra money in their ISAs

Oh Darren, I’m sure you’re one of many but at least a new financial year is beginning!

So important to save for the future – we’ve not got a JISA yet, but the setup of that looks pretty easy.

it’s something you should defo give some thought to Dave. The cahllenge, however, is to put money in it!

Nice piece, I need to sort out our JISAs as all I’ve done so far is convert our CTFs using our existing provider as the whole space was pretty nascent at the time. Will check Orbis out and report back on any others I find.

Pingback: Orbis Access Junior ISA Fee-Free Offer - DigiDads