National Debtline is a charity offering free, independent and confidential debt advice. In this guest post, debt adviser Laura Mostaghimi looks at how parents can save money at this expensive time of year, and where to go if you are struggling to cope.

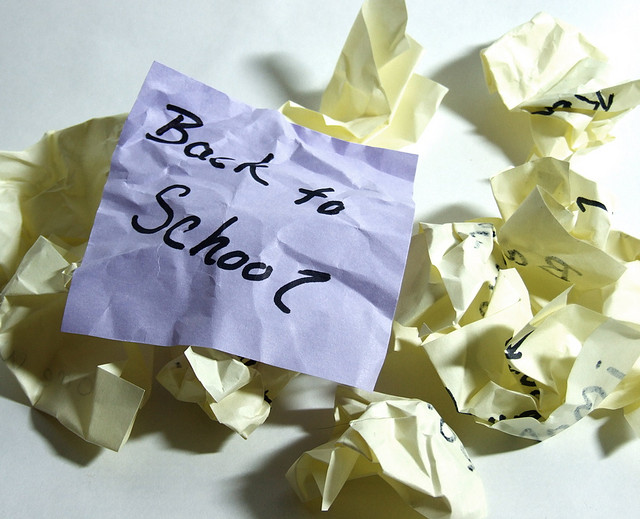

We all remember the excitement of a new pencil case, the pinch of new school shoes, and the prestige of a new lunchbox. But for parents, these costs can be a strain on an already tight budget, especially after the holidays.

It can be hard to say no whilst standing in a shop with a child adamant that if they don’t have the right (and inevitably more expensive) shoes it’ll be a certain social death. Not least with the new shirt/skirt/football boots already in the basket that may not be top of their essential school kit list, but certainly feature a little higher on yours.

The transitions from primary to secondary, and secondary to sixth form, are often the most expensive, with entire new uniforms, books, and for generation Z, tablets, laptops, and whatever else technology throws our way in the next 16 years.

With this significant cost falling right after the summer holidays, and at the start of the lead up to Christmas, the lure of taking on extra credit can be strong, a quick fix to a one-off cost. But those credit card bills and repayments can soon rack up, and what might have been a £100 bill can quickly become a big debt to repay.

The key, as ever, is to plan ahead, budget, and get help if costs are spiralling out of control. One way to avoid the September hit is to get ahead of those ‘back to school’ signs, and shop before the school holidays – many shops have summer sales which can be a great time to pick up shoes and uniform essentials. And if you’re expecting a summer growth spurt, buy a size up. For non-school specific items, like white shirts and grey trousers, shopping around is key to saving money – as well as keeping an eye out all year round for offers and bargains.

For those specialist items, like jumpers, schools often have a second hand system, such as a Facebook group, where other parents sell outgrown items for less. And if your school doesn’t have a system like this, why not set one up and be a money saving hero amongst your fellow parents!

Budgeting for school expenses can be a great way to teach children good money management skills, and to encourage them to shop around. Why not give them a cost limit for their new pencil case and see what bargains they can hunt out? (As long as you’re prepared for a day trawling around every stationers in town…)

It’s never too late, or too early, to put these tips into practice and start making back to school costs a bit more manageable. However, if you’re already feeling the squeeze of a budget stretched too far, help is at hand.

To help keep track of spending, try National Debtline’s budgeting tool which helps you to get on top of your income and outgoings, and get a set of personalised options for dealing with any outstanding debts you may have. If you are struggling to cope, remember you can always give National Debtline a call on 0808 808 4000 (Monday to Friday 9am to 9pm, Saturday 9.30am to 1pm), and talk through your options with an expert adviser, or alternatively receive free advice online via http://nationaldebtline.org

Pic credit; Avolore. Sourced from Flikr.com. Reproduced under Creative Commons agreement.

2 thoughts on “Lessons to be learned in back to school costs”

I always buy the uniform before the summer holidays – because that’s when M&S has the special offers on! Don’t forget to pass uniform down from one sibling to the next. Inevitably, they will wear their trousers out, but school shirts will usually survive for two or even three children – and can be passed from boys to girls or the other way round.

As it happens Sarah, we have a couple of bags of the eldest’s unifrom bagged up ready for re-use when Toddler Adams starts school.