A few years ago we had a rude awakening, quite literally. We were fast asleep in the early hours when our eldest daughter came into the room claiming she could hear someone trying to get into the house. Although we dismissed it as noise from the central heating system, it turned out someone had tried to break into our house, they’d simply been unsuccessful. It was a real wake-up call to take home security more seriously.

We quickly took steps to improve things and installed a CCTV system. We also enhanced our home insurance policy as we noticed it wasn’t quite as comprehensive as we’d have liked.

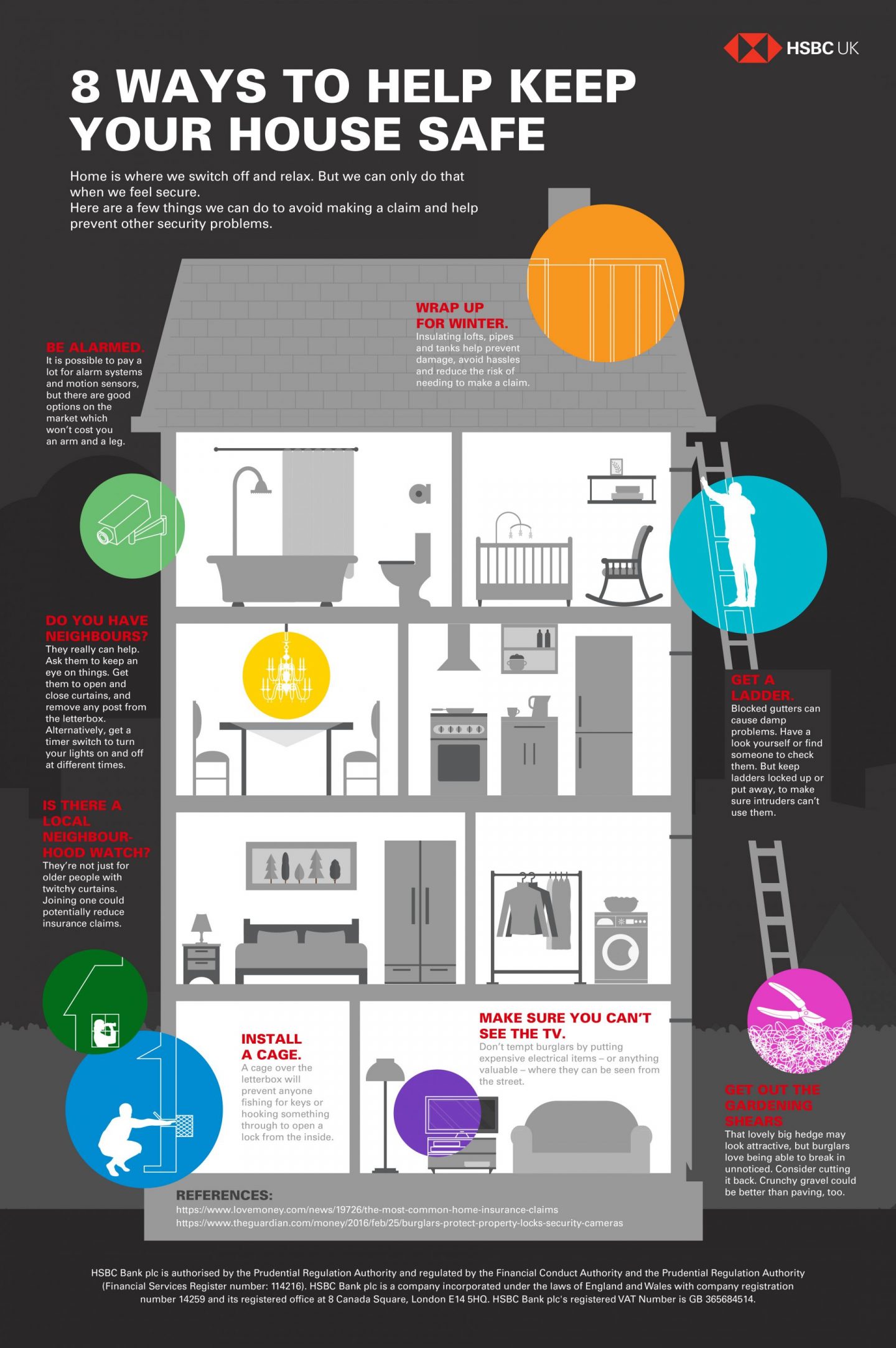

Of course break-ins are just one event that can impact on your home and insurance cover. Burst pipes and blocked guttering can also lead to insurance claims and huge amounts of hassle.

The infographic below features eight ways you can protect your home. I hope you find it useful and if you have ideas of your own, please do leave a comment below.

Disclosure: I was commissioned to produce this article and was compensated for doing so.

15 thoughts on “Ways to reduce claims on your home insurance #ad”

Is there any benefit of fitting infrared cameras in the house?

Would it have an impact on your house insurance? I couldn’t honestly say. I’d check with your insurer.

Great information, Thanks for sharing this informative content with us. keep sharing

My pleasure and thank you for stopping by and commenting.

This article is very helpful for us to know about “Home insurance” services.

This is a really very nice Home insurance.

WoW!! Nice home insurance agency I have ever seen my life. Now I know more about Home Insurance,Thank you.

It’s a very interesting point to put expensive electronics out of sight from windows. My neighbor had their home broken into and they caused a lot of damage inside. I think it’s really smart to try and do what we can to prevent this from happening to us.

Really,This post is an important post for the people of the world.Thanks for this post. I’ll use these tips to try and find a good package for us.

Thank you

It’s great to know that you can actually join the neighborhood-watch if you want to get a discount on your insurance plan. My wife and I are buying our first home this year and we want to make sure that we find the right insurance. I want total piece-of-mind knowing that we are covered if anything happens to our property.

Congrats on buying your first property. I hope it still goes ahead as planned what with all this Covid-19 madness going on. Best of luck joining your Neighbourhood Watch scheme and yes, you want to make sure you are insured for every eventuality.

It is nice that the break-in attempt helped you understand the need for protecting your home. The infographic you have shared is extremely colourful and eye-catchy. It conveys the message in so few words. I also appreciate that you increased the home insurance policy sum to improve security.

Very useful information. The area which I lived to very prone to burglary and theft. Hence I have already purchased a home insurance. Also I have insured by retail shop that have close to my house. Thank you for the valuable tips.

Always have insurance Rohit! You may never need it, but if you ever do, my word will you be grateful for it.

Most people buy their homes by taking a mortgage and in the vent that if they die without paying off the debt, their family may suffer. In such a situation, mortgage insurance is the best solution as it covers your mortgage in case of your death.

I do not understand the relation between the heading (Reduce Home Insurance) & your blog. Please make me clear