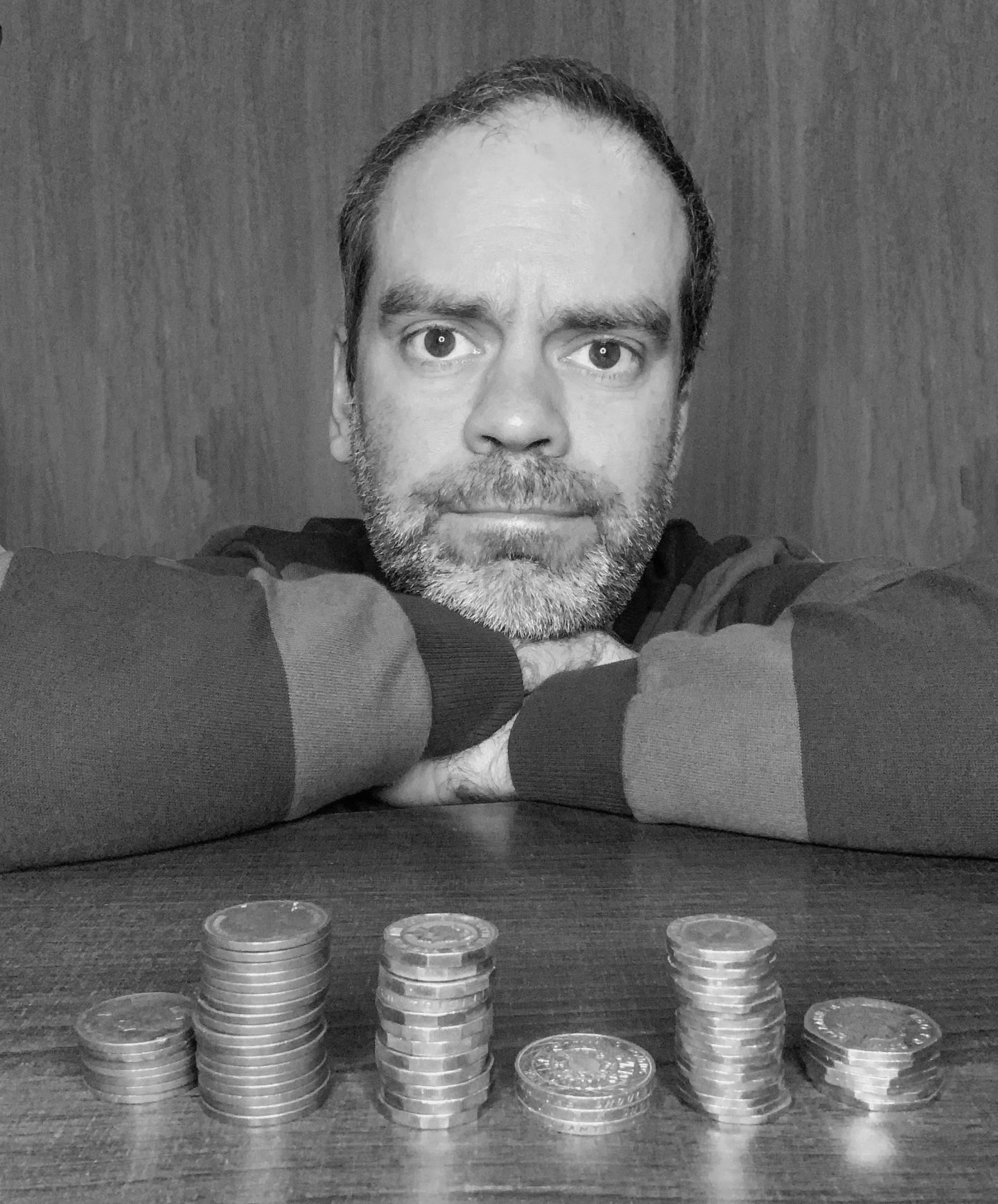

The extreme turbulence of the past 12 months has done little for most people’s bank accounts. The past year was something of a roller coaster ride for me financially. This has inspired me to set myself some financial goals for the next 12 months, goals that I hope will benefit me and my family. I thought I’d share what I am looking to do.

Set aside more for our children’s future

While Mrs Adams and I do set aside some money for Helen and Izzy’s future, I sometimes find myself looking in horror at how much we’ve set aside. Should they choose to go into higher education, I am all too aware that the costs will be phenomenal. With Helen being on the cusp of being a teenager, pressure is building, so I know we need to put more away for the two of them.

Increase my personal pension contributions

I need to take a long hard look at my income and increase the amount I invest in my personal pension. The irony here is that I used to work in the field of pensioner poverty. I know that at this point in time, I’m not investing anything like enough to provide for a comfortable future and of course, working as a freelancer, I don’t have an employer making contributions on my behalf. I am only too aware this is an issue I need to address!

Get our wills reviewed and updated

No one ever likes facing their own mortality but when it comes to wills, it’s much better to face the fact you won’t live forever and get one written. Mrs Adams and I had wills written a few years ago but the children are older now and it would do no harm to take a look and see if any changes should be made.

I also have a story that demonstrates the importance of having a will. It’s not the first time I’ve written about it on the blog so apologies to anyone who has read this story before.

It goes back to when Mrs Adams and I bought our last house. Once the sale was completed, the solicitor said:

“I now want you both to think about wills.”

I was quite cocky about this. I didn’t see the point of worrying about it. If I passed away, Mrs Adams would inherit my estate and use it to provide for the family and if the worst happened to Mrs Adams, well, all her assets would come to me and they’d be used for the benefit of the kids. Alas, the solicitor then hit us with the sucker punch.

“It’s all very well if one of you dies,” he said, “but what if you both die?”

I hadn’t even entertained that thought. Nonetheless, it had the desired effect. Soon after that we both had wills in place!

Review my life insurance

Talking of mortality, it has been a couple of years since I last had my life insurance reviewed. I don’t think anything has changed massively in that time, but it is always best to keep these things up to date.

Travel insurance

In light of all the travel restrictions caused by COVID-19, you could be forgiven for asking “What’s the point in reviewing and renewing your travel insurance policy?”

I normally pay for an annual policy for the entire family. It’s not that we do massive amounts of travel, but living near Dover, we would, under normal circumstances, undertake the occasional day trip to Calais and if we’re lucky we’d go overseas for a longer holiday in the summer.

It’s normally cheaper to have an annual multi-trip policy. This year, however, I will have a discussion with Mrs Adams and may decide we should cancel the insurance. We’ve already decided an overseas holiday is highly unlikely this year. As for day trips to Calais, they clearly aren’t happening any time soon. It may make more sense to cancel the policy we have and buy a new one just before we travel.

Car insurance

Following on from above, I need to review our car insurance policy to check we can still drive in France. If we go to Calais or Northern France we’d usually drive but I’m unclear what impact Brexit has had on such things.

Step up Helen and Izzy’s financial education

With Helen being at secondary school now, we’ve had to give her a certain degree of financial independence. Where big sister goes, little sister follows. Both kids get pocket money and are encouraged / urged / compelled (delete as applicable!) to save some of what they get.

That said, I think we could do better at teaching them about money. I have taken steps to encourage them to look at weights and measures in supermarkets and figure out which are the cheapest items to buy by weight, that kind of thing. I think we shall do more of this and set them some financial goals etc.

What about you?

Those are the financial goals I have set myself for 2021. Have you set any? Are you looking to reduce your outgoings or have any ideas I should consider? If so, please do leave me a comment. It’s great to bounce ideas off of other people.

5 thoughts on “My financial goals for 2021”

Interesting read this John.

In comparison, I lack a lot of insurances, apart from car insurance, and I do often think I should get it all sorted… not sure if it’s laziness or naivety.

I do however offer my kids pocket money and have reviewed it many a time. Bit harsh but when the oldest appears to just flit her money away I stop it, to give her a valuable life lesson.

Good read. Thanks for sharing.

Ah, pocket money dilemmas. When my eldest spends, she spends but she can actually be quite good at saving. As for insurances, it can be difficult to know what to get. I sat down with a financial adviser once and he explained that, because I’m the main carer for the kids, I’d need about 40K’s worth of cover just in case I ever died. That, roughly, is what he calculated my wife would need should the unthinkable happen to me to cover all the care I provide.

Good luck! This past year has been really difficult for everyone with the whole covid crisis hanging over our heads, but failing to prepare is preparing to fail!

I like that, failing to prepare is indeed failing to prepare!

I think you’ve pretty much got everything covered here, John! Except perhaps your mortgage – if you’re coming to the end of a fixed term, it’s worth reviewing to see if you can get a better rate. As a financial planner (and self-employed dad myself) I often have to weigh these different priorities. The one that most often gets left on the ‘to-do list’ is life insurance. People sometimes think it’s ‘dead money’ and ‘it’ll never happen to me’, but sadly tragedies do happen, so it really is the responsible thing to do if you have a young family.