Inspired by an Alanis Morisette album, I recently wrote this blog post reflecting on my younger years. Today, however, I want to look to the future and have a couple of questions for all mums and dads. Firstly, how much thought to give to your long-term future? Secondly, how much consideration do you give to retirement?

This is a subject I’ve written about in the past both on this blog and for the Retire Savvy website. Having worked for a couple of organisations set up to deal with pensioner poverty, it’s a subject close to my heart. I’m a firm believer that planning from a young age is one way avoid problems in later life.

I have to confess that I previously held a very uncompromising view. I was convinced my generation was sleepwalking into a retirement apocalypse (…and leaving a huge financial mess behind for their children to clear up).

A few weeks ago, however, I posted this question on the Retire Savvy forum. I asked whether young people give enough thought to retirement. To my amazement it’s been viewed 1,265 times and received almost 50 comments. It’s even attracted a comment from Baroness Altmann, a Government Minister and life peer who champions the needs of older people in the workforce.

Admittedly the comments were a mixed bag. Some individuals stated the younger generations are foolhardy with their money. Even so, a couple of very interesting themes came out of the discussion.

One of the themes, probably familiar to all parents, is that once children come along, your priorities change massively. You may have every intention of planning for your own future, but in reality you get bogged down dealing with Junior ISAs and putting money away to help your kids when they go into higher education or buy property.

The other theme is that anyone under the age of 50 is facing financial struggles unheard of by the previous couple of generations. House prices have rocketed and it takes years to save for a deposit, even with financial help from family members. Students at English higher education establishments leave their studies tens of thousands of pounds in debt and their priority, quite understandably, is to get back into the black, something that takes years and years.

Previous generations also benefited from gold-plated defined benefit workplace pensions. Such schemes are now a rarity and most people are in less generous defined contribution schemes. Added to this, when you do reach your twilight years, you may have to sell the family home to pay for your care.

It’s all very well to say young and young-ish people are irresponsible and live for today instead of investing for tomorrow. In truth, this is a very simplistic viewpoint. I’ve come to the conclusion we’re having a much tougher time of it than our parents and grandparents. We’re so focused on getting by from day to day, we can’t think about the future, certainly not until we’re empty nesters, by which time it may be too late.

What do you think? Have you given any consideration to retirement? If not, what stops you from thinking about it? Are you scared for the future and do you agree those of us aged 50 or less face a major battle just to get by, let alone invest for out later years?

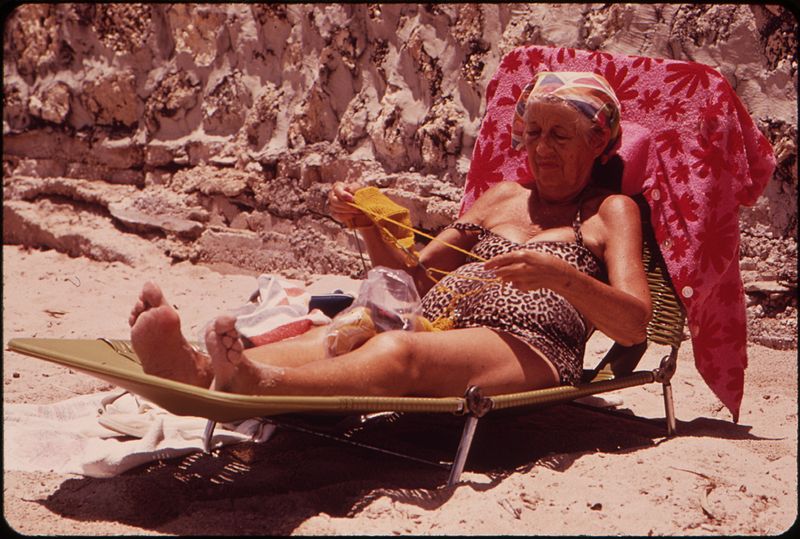

Pic credit: Copyright-free image courtesy of the US National Archive and Records Administration.

Disclosure: I am a regular contributor to the Retire Savvy website and am compensated for my efforts.

5 thoughts on “Mums and dads, do you think about the future?”

When I was in my 20s there was a big recession and I wasn’t thinking ahead seriously until well into my 30s as I was working to live and saving for a house deposit. But I know people who were saving into a pension from 18, so perhaps it comes down to personality as well as circumstances. What affects everyone is that in real terms incomes have fallen in the past five years – possibly for the first time since the end of the second world war. Planning for retirement is very hard indeed when every month there is little left over after mortgage, bills and childcare. I wish I could say I have a pension but I don’t so I will have to make sure I’m doing something I love in order to earn money when I’m 65! I hope my son manages to plan ahead and has the income to put something aside. I’ll certainly be warning him with my own story.

Dreadful isn’t it when you have to use yourself as an example to ensure your kids don’t make a mistake?? There’s still time to invest in a pension Adrian and to give the other elements of retirement some thought. Best of luck!

Great post.

I hope if I manage to teach my children two things about being financially responsible it’s don’t get into unnecessary debt and make provisions for the future!

Since the last recession I think my husband and I have had a huge kick up the bum in terms of making provisions for when we are older. However we are still not 100% sure on the best way to go about this and still learning.

I think you hit the nail on the head when you say it is more difficult being sub 50 now than it was for our parents and grandparents-our main concern a few years ago was being able to get a foot on the housing ladder and hardly any thought went into putting money away or investing in our future, it’s also really hard with us both being self-emplyed. It’s hard even thinking about it when you need to meet that monthly mortgage payment etc. Luckily now my husband’s business has picked up since the recession and only now can we start thinking seriously about it all.

I’m desperately trying to teach my eldest about saving and so on. We’re getting there. Here’s a scary thought for you….according to the MOney Advice Service, saving and spending habits are fixed by the age of seven!

Good luck making porovisions for the future. I see you’ve visited the Retire Savvy site. Hopefully you’ll find lots of useful information on there.

Mm interesting and a bit scary John! I buried my head in the sand til I was knocking on the door of 30 before getting a pension but then my starting salary at 25 was £10,000 and even in the late-90s that wasn’t much! I think as a mum who works part time now (or even more so in the case of a stay at home mum/dad) you know that you will have a massively reduced pension even if you do have one and then you will rely on your partner to balance it out – but what if you break up some time over the course of the following 30 years? What then? I guess there are provisions but I still worry. Right now what savings I did have ten years ago when I could still afford to save are dwindling away – this month its new brake discs and my car’s service and MOT – there is no such thing as saving in this climate/on a part time salary. #thetruthabout